With gratitude to our customers, 2021 proved to be an active, productive year. We also began a new era for our bank. While continuously adapting to the challenges of the pandemic, we consolidated our three state banking charters. Maintaining our mutuality, Collinsville Bank and Litchfield Bancorp became operating divisions of Northwest Community Bank. With extensive multi-channel communication, our customers were informed, assisted and necessary account adjustments were made. The success of the process is testimony to the great relationship our customers and employees have. Moving ahead, we will continue to strengthen our connections with our customers and community.

Though the pandemic certainly affected many facets of business and daily life, we continued to work hard to serve all of our customers – from Paycheck Protection Program (PPP) business loans to first-time homebuyers to non-profit organizations in financial need. Specifically, we provided $68 million in PPP loans and were pleased to be there to help our business customers. We also funded $87 million in commercial loans and $151 million in residential loans. Internally, we were fortunate to have a talented, resilient team of employees who provided the high volume of services we needed.

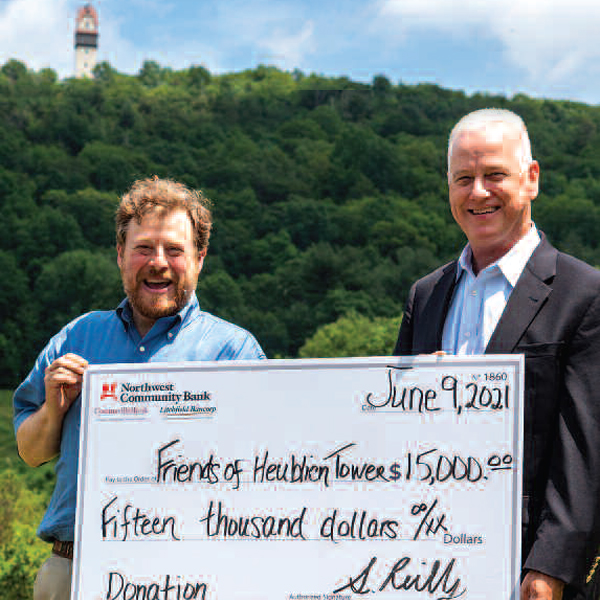

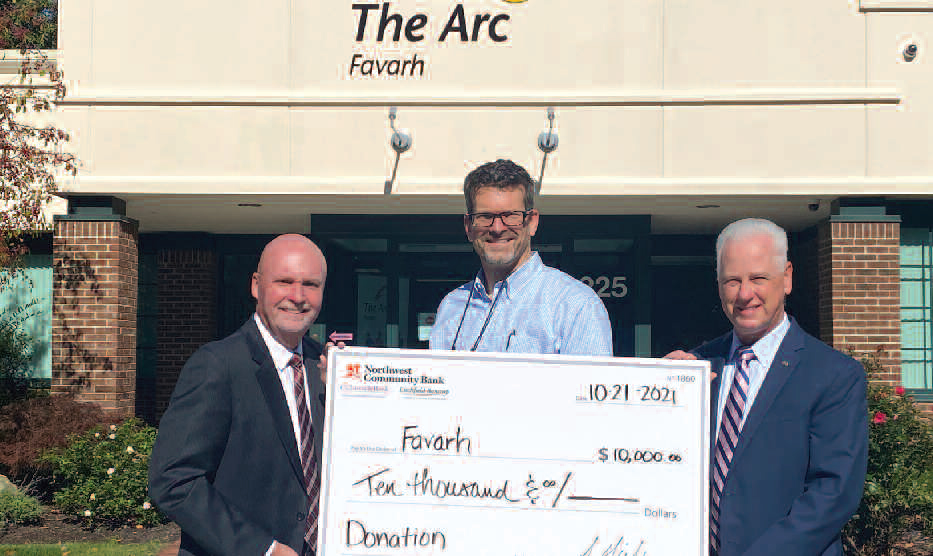

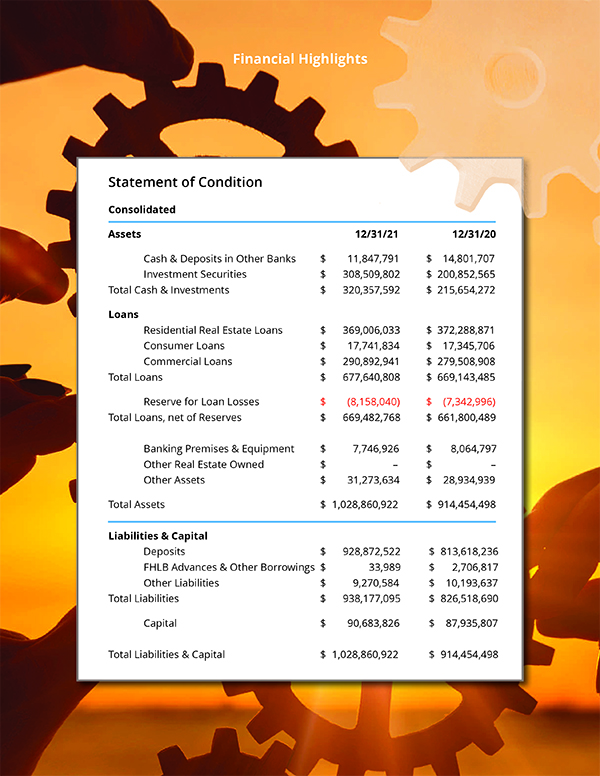

We ended 2021 in a very solid financial position, with increased earnings and a strong balance sheet. Over the course of the year, we were able to contribute $400,000 to non-profit organizations in need. Today the bank continues to contribute to many organizations and causes throughout the area. In addition, last year we prepared to launch the Northwest Community Bank Foundation, a separate charitable entity established in January 2022. The new Foundation has already approved $180,000 in grants to 24 worthy organizations in its first cycle of 2022. Our success stems from the support of our customers who enable us to build community through financial and volunteer contributions.

Today we have the ability to provide larger commercial loans and serve a greater number of business customers – while maintaining traditional hands-on attention. We are constantly investing in products, services, technology and training to offer the best opportunities possible to our customers and employees alike. Pulling together, we distinguish ourselves from national and regional banks.

Now halfway through 2022, we are well positioned to address the global, domestic, local and personal conditions that affect us all. We are committed to prudent management and know we can rely on our loyal customers and dedicated employees. Of course, our customers are our best ambassadors, and we are thankful for that.

With over 170 years of experience navigating through historically difficult periods, we’re confident we have what it takes to meet the demands of the future. We are grateful for your trust in us as we move ahead.

We look forward to a time of peace and prosperity for all.

Sincerely,

| Stephen P. Reilly President & CEO  |

William J. Shea II Chairman  |